Guest

Guest

Sep 29, 2025

9:51 AM

|

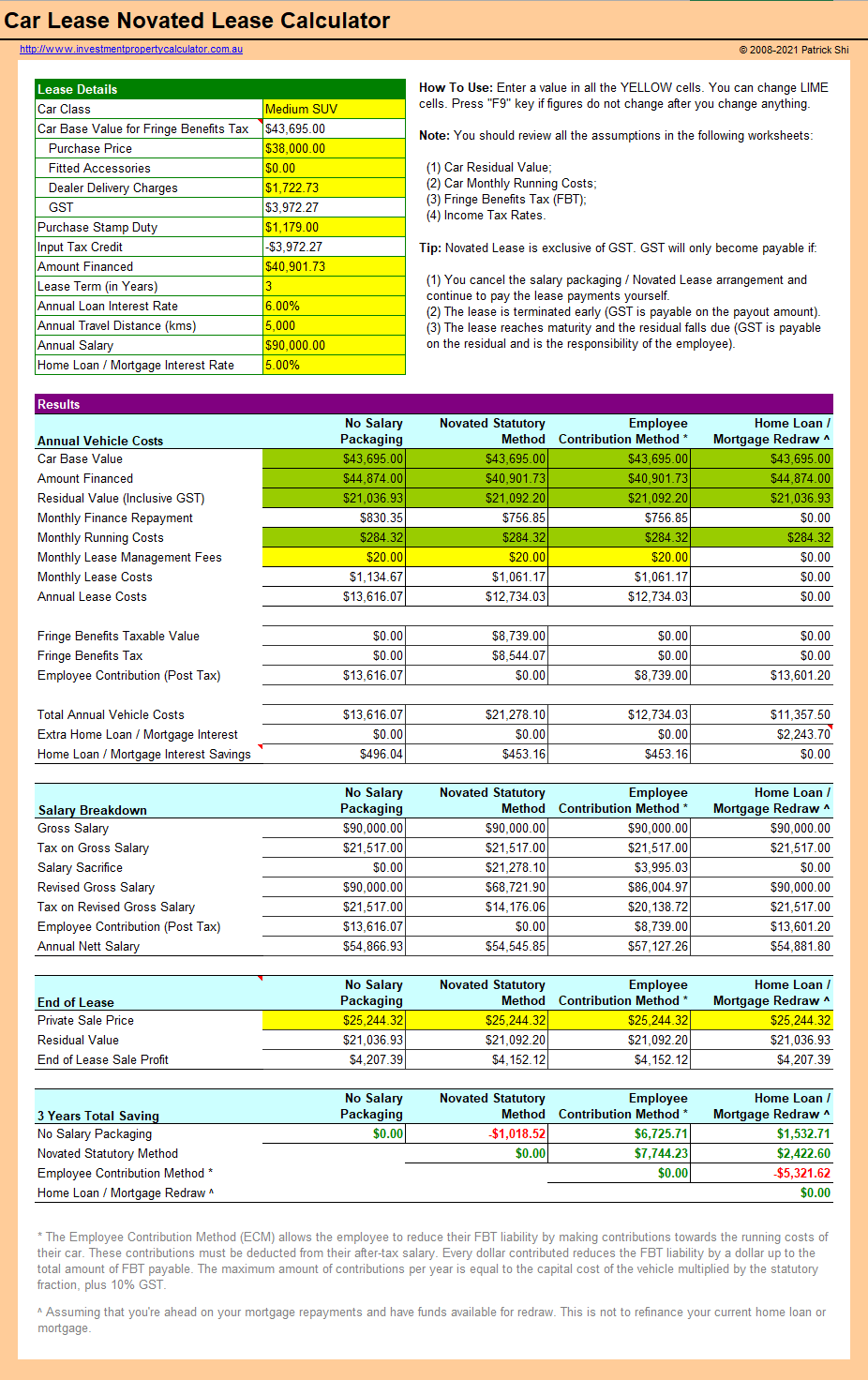

An example of a novated lease arrangement

If you get paid $70,000 per year (before tax) and your novated lease payments amount to $10,000, your taxable income becomes $60,000 (if you pay all of your novated lease payments from your pre-tax salary). This means you’ll pay less tax over the year. Your finance provider or an accountant can help you to work out the potential savings and the other things you’ll need to consider before entering into a novated lease based on your personal circumstances Novated Leasing Calculator.

Keep in mind that if you change jobs or stop working, the responsibility for making the repayments remains with you. You may be able to transfer your lease to your new employer, but you may also have to take over the

|

To enhance your user experience on our website, this site uses cookies.

If you continue to browse, you accept the use of cookies on our site.

See our Privacy Policy

for more information.

To enhance your user experience on our website, this site uses cookies.

If you continue to browse, you accept the use of cookies on our site.

See our Privacy Policy

for more information.